The escalating severity of the novel coronavirus (COVID-19) outbreak throughout the world has led to heightened measures being implemented to curb further rises in cases and prevent the transmission of the virus in communities.

As a consequence of these measures, businesses are seeing a huge impact on their income and and their ability to retain employees as they struggle to maintain cashflow.

Taking that into consideration, since Singapore's month-long "circuit breaker" period started on Tuesday (7 April), food outlets have seen a significant decline in sales while many other businesses were largely deserted or asked to shut down.

With the Circuit Breaker being put into action, many businesses will inevitably experience a massive drop in sales, canceled projects, delayed payments, and going deep into their emergency fund.

To mitigate this problem and ensure the continuity of every business, here are a few initiatives in Singapore that businesses could explore to help them maintain their operations and cashflow for upcoming months.

Government Initiatives

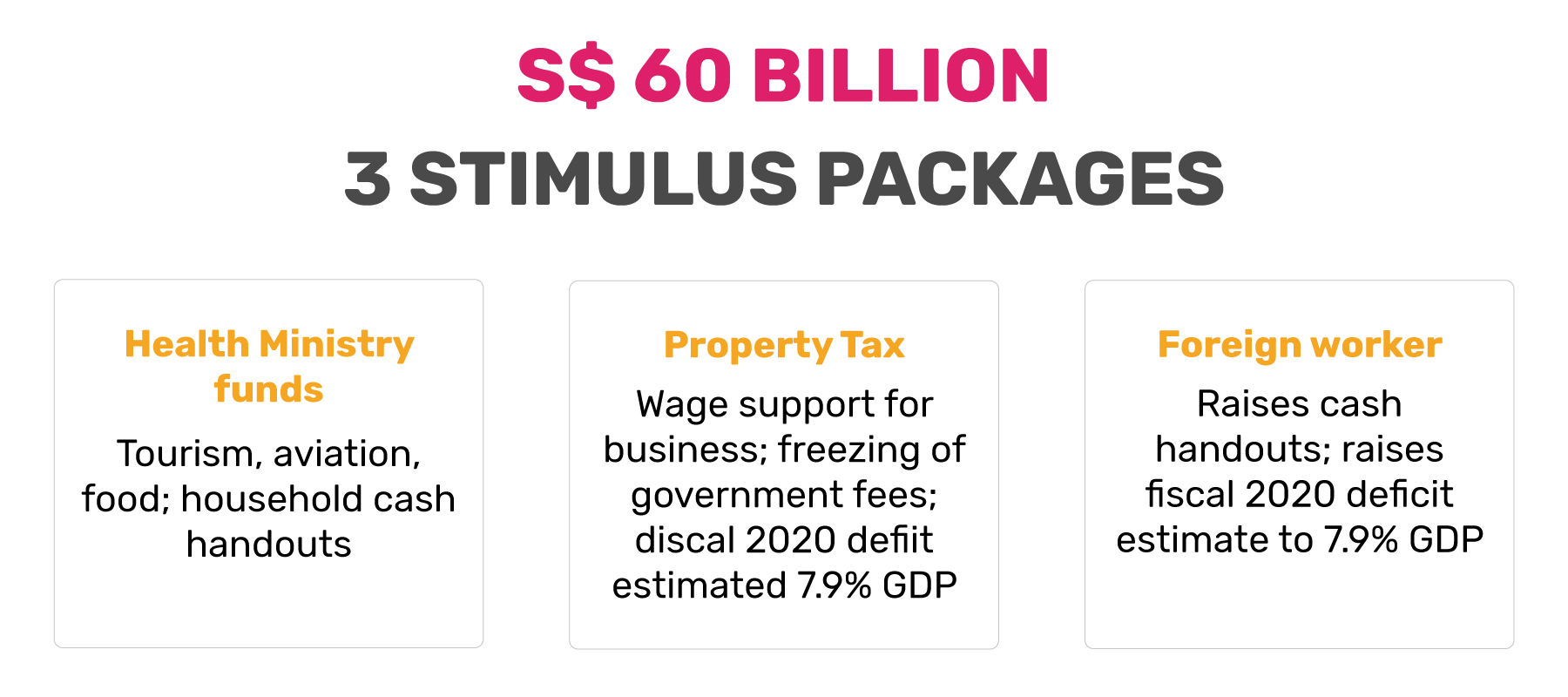

As of Monday, April 6, the Deputy Prime Minister Heng Swee Keat has announced measures in Parliament, taking the nation's total virus relief to almost S$60 billion. Below are the three stimulus packages announced so far with the primary aim to save jobs and protect the livelihoods of the people during this temporary period

To further understand how this works, below is the breakdown of the allocation of budgets.

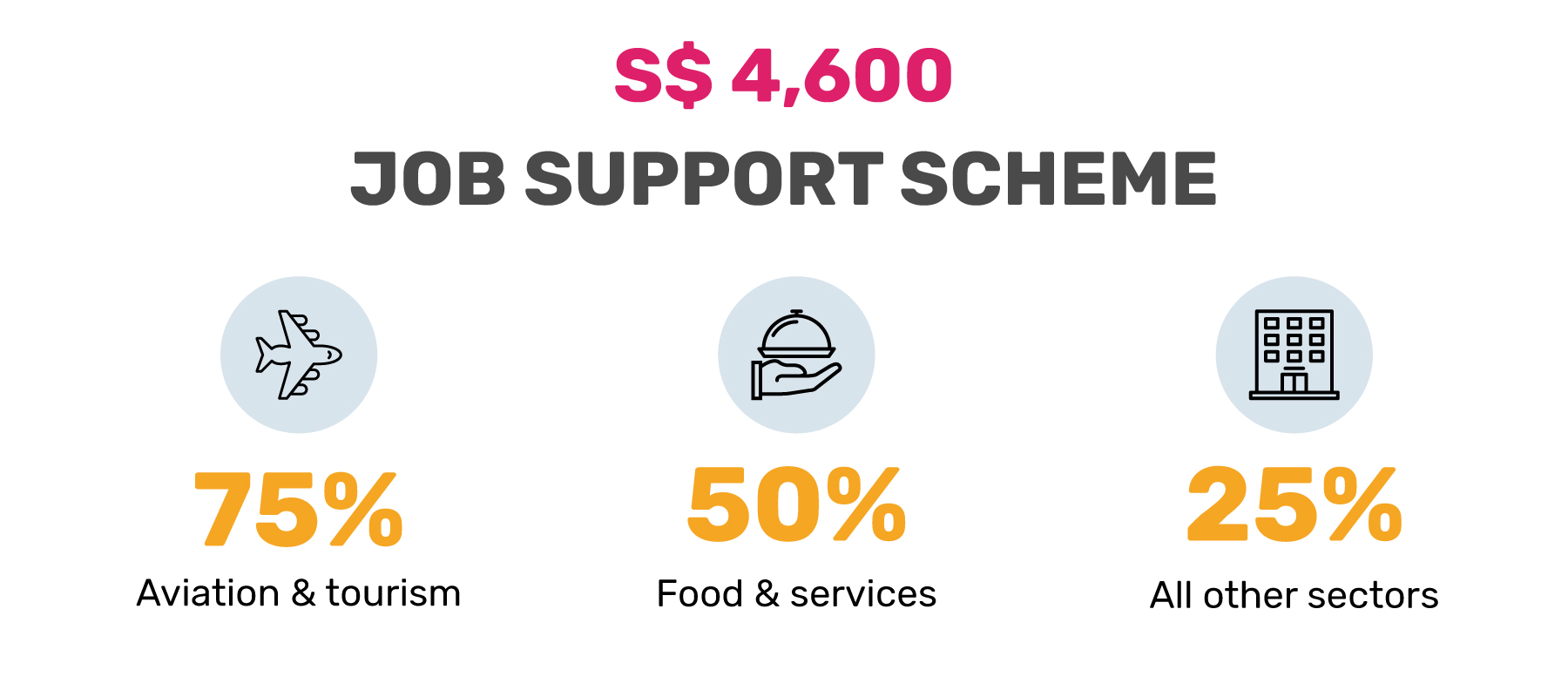

Singapore’s government is putting in plans to secure employment through the Job Support Scheme. This scheme primarily serves to support employers in wage payouts and to help them retain their local employees during this period of economic uncertainty as an addition to the Wage Credit Scheme.

This scheme entails that the government will co-fund the first $4,600 of gross monthly wages paid to each local employee for 9 months.

In addition to that, for the month of April 2020, the JSS wage support will be increased up to 75% for all sectors to support businesses as they ‘circuit breaker’ period. Below are the three levels of support for employers in different sectors under the Job Support Scheme

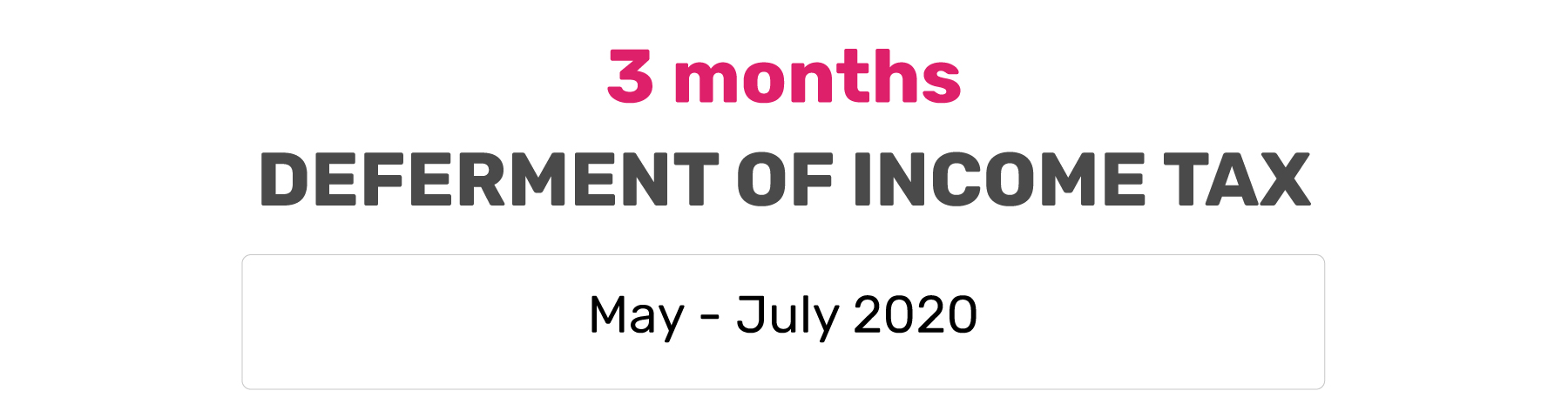

To further ease cashflow as businesses await cash from wage support schemes, local companies and self-employed individuals can opt for a deferment of income tax payments for 3 months from May to July 2020.

This means that their income tax deduction shall only resume in August, September or October 2020 and the end-date of their installment plan will be extended by 3 months, however, having said that, the amount of income tax payable will still remain the same with no deduction applicable so far.

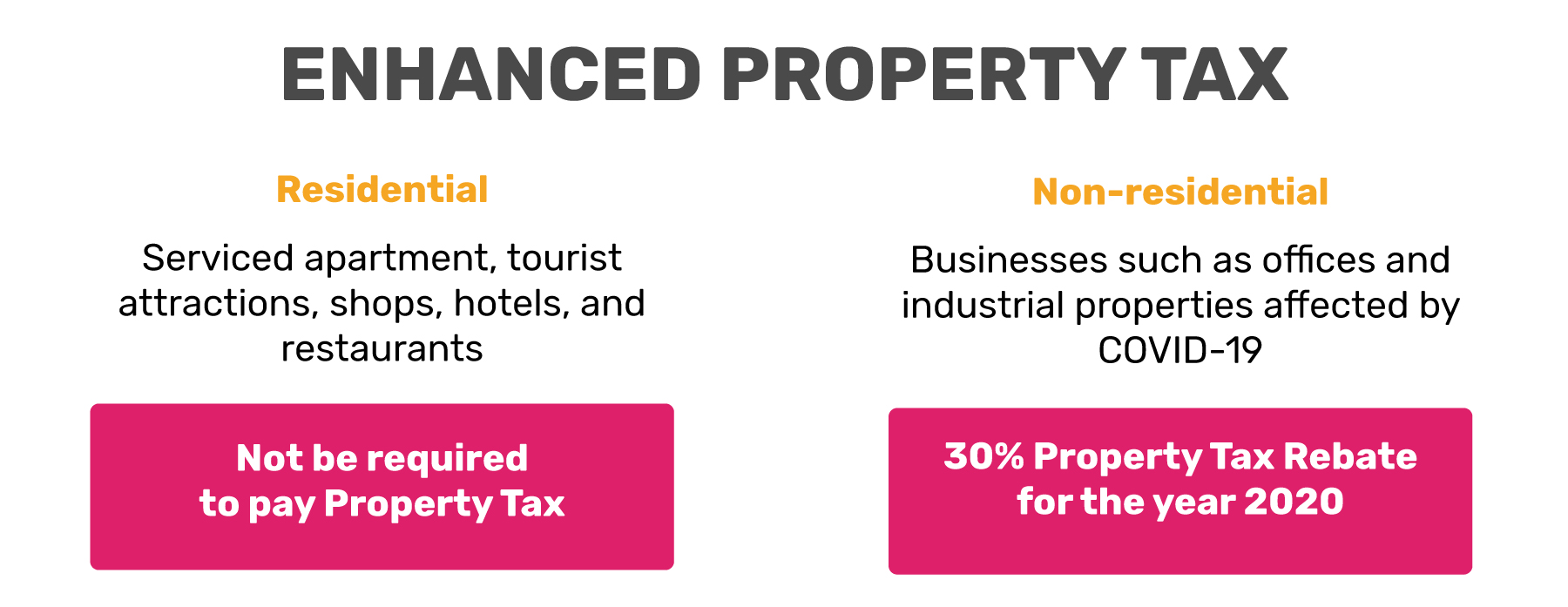

Property Tax rebates, which was announced in the Unity Budget will be further enhanced, by increasing the amount of the rebates and covering more types of properties:

Residential Businesses: Qualified commercial properties that have been more seriously affected by the COVID-19 outbreak will not be required to pay Property Tax. These include serviced apartments, tourist attractions, shops, hotels, and restaurants. This is an increase from the 15%-30% Property Tax Rebate announced earlier.

Other non-residential properties: businesses such as offices and industrial properties affected by the COVID-19 will be granted a Property Tax Rebate of 30% for the year 2020.

Landlords are urged to reflect the rebate to tenants by reducing rentals, to immediately ease the cash flow and cost pressures faced by tenants.

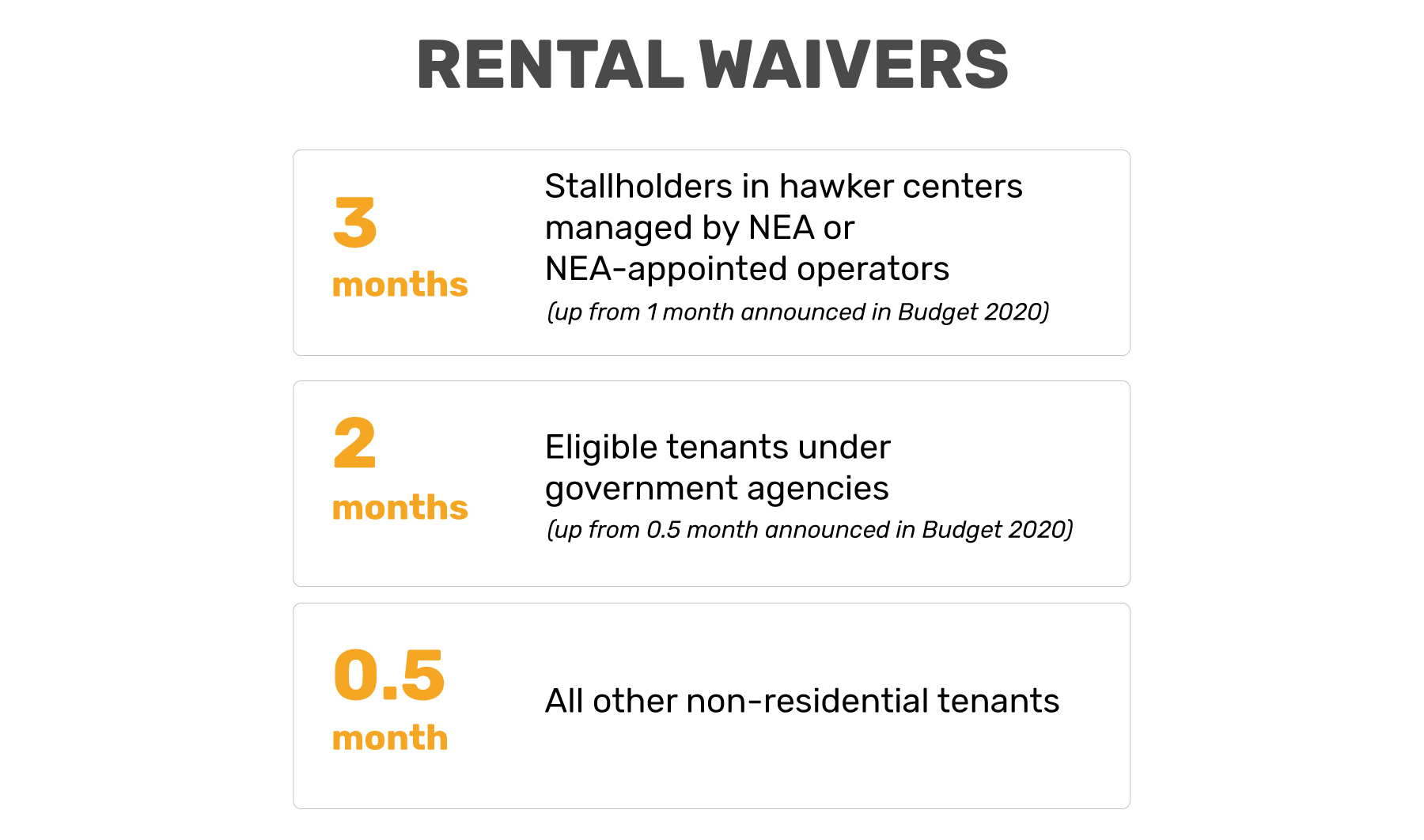

Rental waivers will be enhanced to support tenants.

Enhanced Financing Schemes

The government will continue to enhance financing schemes to ensure that every business is given access to easy financing and credit.

Enterprise Financing Scheme (EFS): Some of the earlier enhancements were made to the SME Working Capital Loan that specifically work to alleviate cashflow problems for SMEs. Through this scheme, SMEs could get up to $1 million financing with a maximum repayment period of 5 years.

Temporary Bridging Loan Programme (TBLP): The TBLP was introduced to provide working capital for enterprises in the tourism sector. eligible enterprises may borrow up to $5 million under the TBLP, with the interest rate capped at 5%.

EFS Trade Loan: The EFS Trade Loan will be enhanced to support businesses’ trade financing needs, with the maximum loan amount being increased from $5 million to $10 million, and an increase in the Government’s risk-share to 80%, from 70%.

Loan Insurance Scheme

Through this scheme, enterprises can get short-term trade financing loans via the Loan Insurance Scheme (LIS) from Participating Financial Institutions (PFI). These loans are insured by commercial insurers which co-share loan default with the PFI

In addition to these, businesses and individuals facing problems with cash flow will receive help from the Monetary Authority of Singapore, which is working with banks and insurers, for their loan obligations and insurance premium payments.

Non-Government Initiatives

Every help goes a long way in ensuring everyone can stay afloat - local businesses are the backbone of Singapore and these are tough times for everyone especially our local businesses who have seen a sharp decline in footfall and customers.

In the light of that, local businesses have come together to help each other push through this trying time, so here are some of our favorites:

iSaveSG

This “promotion platform” to help restaurants, bars and other local businesses that are affected by the COVID-19 crisis. The newly formed website bills itself as completely free of charge for both merchants and customers using the platform. It has a growing database of discount coupons and merchants get to keep 100 percent of the profit.

Fave solidarity for merchants

On the other hand, while Fave is currently highlighting their SaveOurFave movement in the neighboring country (Malaysia), Fave Singapore has put forth some initiatives to help local businesses and their customers better adapt to the new environment.

Enabling Dabao (Takeaway)

To minimize the interaction time between the F&B stores and customers while still allowing the store to retain some business, Fave is featuring Dabao deals on various channels enabling customers to order, browse and to pay in the safety and comfort of their home.

Fave is also cutting 50% takeaway fees and reducing commission rate for deals during this difficult time to help businesses maintain cashflow

Manage cashflow by receiving up-front payment

Local businesses get up-front payment from every eCard purchase. This helps to sustain them in this trying period as Fave has imposed reduced fees on eCard purchases

As we do not know when this fight will be over, we should be actively engaged in monitoring the situation in Singapore daily and evolve our support based on results and feedback. United we can do this! #SGUNITED