In the midst of this pandemic crisis, the government of Malaysia has enforced stricter regulations nationwide to hasten the spread of the COVID-19 outbreak.

One particular segment that is impacted by these unprecedented circumstances is the Small to Medium Enterprises (SMEs). The SMEs have voiced out their concerns over the long period of MCO as they experience a huge drop in customers spending and face the growing strain on their financial capabilities.This will not only affect their ability to continue their business operations but also the economy as a whole as they play a pivotal role in the development and growth of the Malaysian economy. SMEs provided 66.2% of total employment in 2018 and constitute 98.5%, or nearly one million, of all business establishments.

With that being said, for the economic well being of the country, it is crucial that we highlight and aid the sufferings of SMEs.

So here we listed down some measures to assist small and medium-sized enterprises (SMEs) to maintain their ability to continue business operations and cushion the impact of disruptions caused by the COVID-19.

Deferment and Restructuring of Financing Facilities

To aid SMEs in maintaining their cash flow that are likely to be affected by the disruption in business operations, banking institutions will provide a deferment of all financing repayments for a period of 6 months, effective from 1 April 2020.

One advisable thing to do here is that SME owners with financing commitments should understand and discuss with their banking institutions on the options available to avoid accrued interest rates and other possible complications. On a side note, if they would like to turn down this deferment offer so they can continue with their current repayment structures.

Easier and Enhanced Financing Facilities

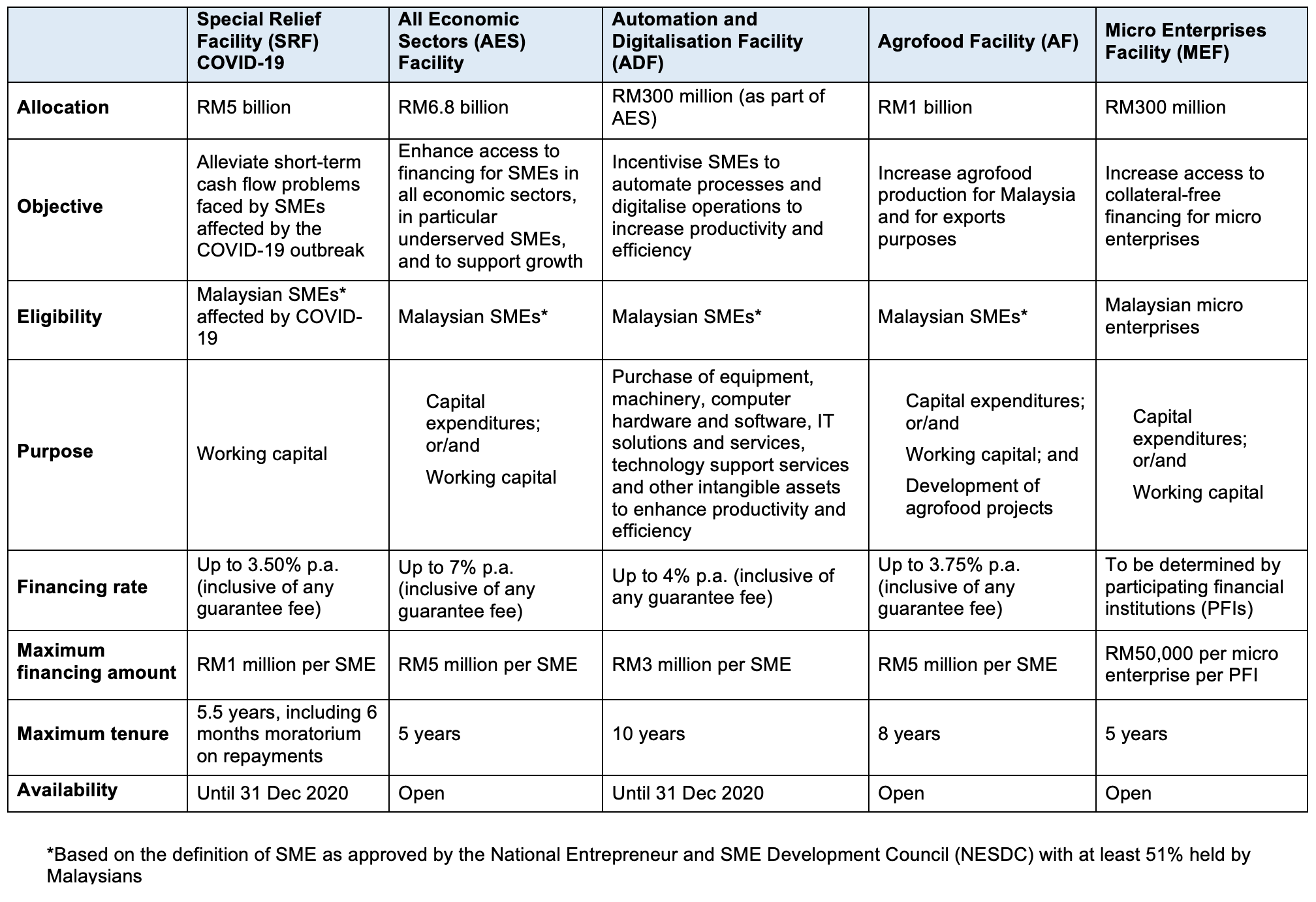

BNM is aiming to provide assistance to SMEs in sustaining business operations and protecting jobs by enhancing the existing financing facilities under the BNM’s Fund for SMEs (the Fund) and increasing the allocation of the facilities. The enhancements under the Fund are as follows:

1. An increase in the allocation of Financing Facilities

As part of the effort to help businesses affected by the COVID-19 outbreak, here are the enhancement of financing facilities that includes the Special Relief Fund(SRF), All Economic Sector (AES), Agrofood Facility (AF), Automation and Digitalisation Facility (ADF).

Refer to the table below to understand each financing option respectively.

Source of information: Bank Negara Malaysia (BNM)

The SRF, AF, and ADF were made available from 6 March 2020. Since then, participating financial institutions (PFIs) have approved a total of RM119 million of financing to approximately 196 SMEs, with an approval rate of 84% and a grace period of 6-months repayment.

2. Micro Enterprises Facility (MEF)

To help microenterprises thrive in this challenging business environment and encourage entrepreneurship capability among B40. SMEs may also explore the Micro Financing Facility. Through this scheme, viable enterprises could get up to RM50,000 of financing for working capital or for capital expenditure. The scheme requires no collateral, with minimal documentation required and provides for quick approval and disbursement.

3. Credit Guarantee Corporation Malaysia Berhad (CGC)

For financing of RM30,000 to RM300,000, with maximum profit rates of 12% and up to 5 years tenure, SMEs can also check out BizMula-i and BizWanita-i financing schemes under the CGC.

BizMula-i

To facilitate greater access to financing for viable SMEs. This direct financing scheme caters specifically for businesses with less than 4 years in operations utilizing the BNM’s Fund for SMEs – All Economic Sectors (other than SMEs in the Primary Agriculture Sector and Micro Enterprises)

BizWanita-i

Just like BizMula-i, BizWanita-i is a direct financing scheme designed to facilitate greater access to financing, what’s different is that this scheme specifically caters to women entrepreneurs with businesses less than 4 years in operations utilizing the BNM’s Fund for SMEs (other than SMEs in the Primary Agriculture Sector and Micro Enterprises).

4. The Business Financing Guarantee Company (SJPP)

Increase the guaranteed rate from 70 percent to 80 percent for SME companies that have trouble getting loans.

To apply for one of the financing facilities, interested SMEs may call or email the participating financial institutions (PFIs) or visit here.

One thing to note here is, due to the overwhelming response, there may be some delays in the applications and disbursements process from participating FIs to process the applications received under these facilities. SMEs are encouraged to remain proactive in their effort to maintain cash flow.

5. PENJANA Short-Term Economic Recovery Plan

Under PENJANA, the government has allocated an astounding 35 billion in total fund for various incentives and campaigns to help the country recover its economy from the long MCO period. Especially to help micro, small and medium enterprises to bounce back. Fave as an official partner for PENJANA is allocating RM10,000 in marketing budget for every merchant under the Micro and SMEs E-Commerce.

Collective Local Initiative

Financial aid could definitely be of help for businesses to survive by helping businesses to continue paying their bills, rent, suppliers, staff and more but at the end of the day, we'll still need customers to start spending to improve the economy.

Many Malaysian celebrities including Ean from Hitz FM, Altimet, Sasi The Don, Moots from Pop Shuvit, Dina Nadzir, comedian Harith Iskander and others have come together to help SMEs rally Malaysians to help their favorite merchants during the Movement Control Order (MCO) period through the Save Our Fave campaign.

With their support, we've seen 3 fold growth in sales. Additionally, merchants are also able to fully benefit from this with ZERO commission charged until 30th April.

The campaign is mainly about asking people to save their favorite merchants through purchasing eCards as it helps businesses get quick up-front payment while giving customers the ability to do so from the comfort of their home.

If you or anyone you know is one of the affected business owners, you can find out more about how Save Our Fave can aid you in maintaining cash flow here or additionally, if you happen to know any other aids for SMEs let us know so we can all benefit from it.

These measures for SMEs are seen as a collective effort to provide support in sustaining business operations, preserving millions of jobs and encouraging domestic investments which will ultimately safeguard the country’s economic growth.